Historically, we tend to talk about “compound interest” as a positive concept when saving money. This post focuses on the other side – the negative power of compound interest. We will speak to the crippling impact of compound interest when taking on debt, using credit cards as an example.

How Credit Card Debt Works

Imagine that you have a credit card and you begin by carrying a $1,000 balance. That means that you charge $1,000 on your credit card, and one month later you don’t pay off the $1,000 you borrowed in full – you carry that $1,000 as a “balance”.

Next, check the fine print of your credit card to look up how interest you will be charged. This is called Annual Percentage Rate (APR). A longer post on APR is located here.

Let’s say your APR is 20% (credit cards typically range from 15-25%). This rate compounds daily.

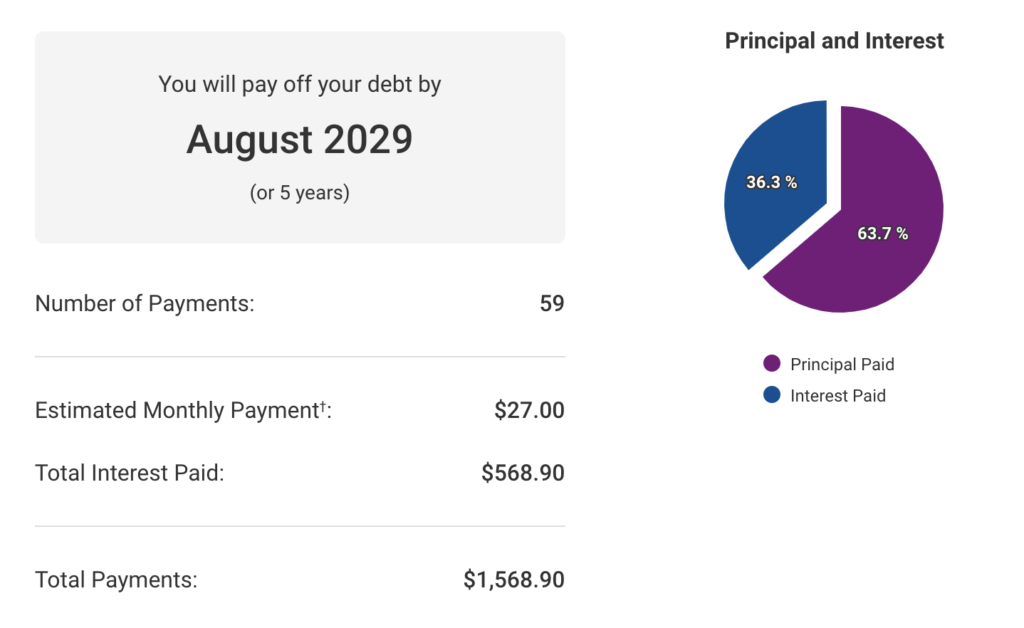

In month one, you make the minimum payment of $27 and you continue making ONLY the minimum payments. You won’t be able to pay off your debt until August 2029 that’s five years from today’s date.

Experian offers a helpful Credit Card Payoff Calculator that helps calculate compound interest, specifically for managing debt.

You can see that not only will it take five years to pay off the debt, but you’ll also end up paying more than 50% in interest by making only minimum payments.

Final Thoughts: Compound interest on debt can quickly cripple finances

While compound interest can work in your favor when saving, it can also have a crippling effect when it comes to debt, especially with credit cards. The daily compounding of high-interest rates can quickly turn a manageable balance into a long-term financial burden if only minimum payments are made. Understanding the impact of APR and compounding interest is key to managing debt effectively. To avoid falling into this trap, prioritize paying off your balances in full each month, and consider using tools like payoff calculators to stay on track.

1 Comment

The Power of Compound Interest When Investing - Dyneri · October 2, 2024 at 8:11 pm

We’ve heard of compound interest, and while it can work against you in debt, it’s a game-changer when it comes to growing your savings. If it feels overwhelming, don’t worry – the key is simple: compound interest helps your money earn even more money over time.